Experts urges corporate companies to explore non-interest finance window in capital market

Experts urges corporate companies to explore non-interest finance window in capital market

Stakeholders have listed non-interest finance opportunities in Nigeria’s capital market and urged corporates entities and investors to explore the investment window.

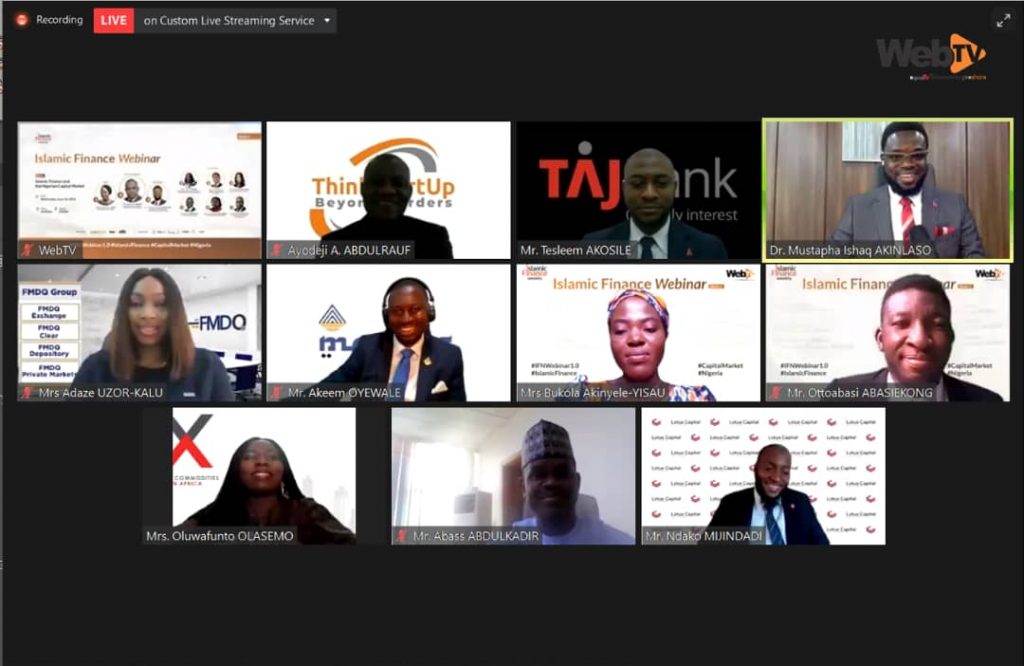

They spoke at the maiden edition of Islamic Finance webinar series hosted by WebTV (digitalTV powered by Proshare) in Lagos on investment opportunities in Nigeria’s Non-Interest Capital Market (NICM).

Mrs Bukola Akinyele-Yisau, WebTV, Islamic Finance Weekly Programme Anchor, said this in a statement made available to the News Agency of Nigeria (NAN) on Thursday in Lagos.

Akinyele-Yisau said the webinar was an avenue to enlighten corporate entities and investors about non-interest finance opportunities in Nigeria’s capital market, while addressing salient issues affecting the growth of the market.

She added that it was essential to enable stakeholders deliberate on avenues to synergise efforts to grow the industry.

The statement quoted Mr AbdulKadir Abbas, Head of Department, Securities and Investment Services, as saying that the Securities and Exchange Commission (SEC) was committed to the growth and development of NICM.

Abbas, in his the keynote address, added that the growth of the NICM in the country had been fueled by the increase in Sukuk bond issuances amidst a growing appetite for the instrument by local investors.

Speaking on the Capital Market Master Plan (2015-2025) developed by the commission, he said the goal was to ensure that the NICM sub-sector represent 25 per cent of the overall market capitalisation by 2025.

Abbas explained that Sukuks would represent 15 per cent of total debt issuances outstanding by 2025.

He noted that in 2004, SEC joined the IOSCO joint committee on the Islamic Capital Market in Nigeria which led to the development of several initiatives to deepen the market.

Abbas said the commission would continue to promote enabling regulations to make Nigeria the regional hub for non-interest finance in Africa through collaboration with market stakeholders to introduce regulations that provide level playing field for all participants.

He added that SEC would foster partnerships for capacity building to build an innovative and efficient NICM.

Accoridng to him, the commission will embrace digitalisation to support innovative products and developing a dynamic fair, transparent and an efficient market where investors and businesses in Africa could invest and raise sharia-compliant capital.

On his part, Mr Tesleem Akosile, who represented the Managing Director of TajBank, Mr Norfadelizan Abdulrahman, said there were enormous opportunities for non-interest banks to collaborate with other stakeholders to build a vibrant Islamic finance ecosystem.

He identified areas like wealth management as a means to develop products for high-net-worth individuals and other classes of citizens, thereby driving financial inclusion and economic empowerment.

Mrs Adaeze Uzor-Kalu, Head, External Affairs, FMDQ Group in her presentation said Nigeria was one of the pioneering nations that established an Islamic Finance Regulatory framework in the West African Region.

Uzor-Kalu said the total global Sukuk market from the debt market perspective had reached $715.2bn in Q1, 2021 which was three per cent higher than amount in Q4, 2020.

On prospects for developing Islamic finance through the debt capital market, she stressed the need for a standardised and robust regulatory framework for Sukuk issuance.

Uzor-Kalu also called for government and regulatory incentives to drive participation in the Islamic finance sector.

According to her, there is a need for heightened awareness on Islamic Finance and build capacity in key institutions and increased primary markets issuances of Sukuks and Islamic commercial papers.

She explained that Islamic financing was critical to improving financial inclusion as it takes account of Shariah-complaint market players.

Leave a Reply