FBN Holdings 2023 earnings per share doubled on higher operating income

By Kayode Ogunwale

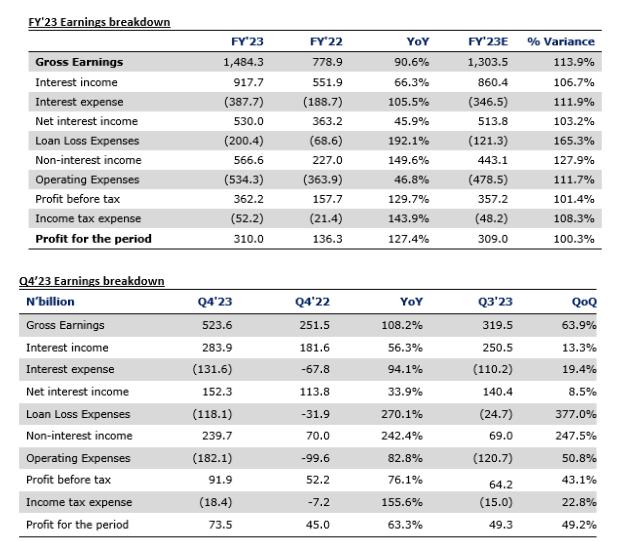

The financial giant, FBN Holdings Plc have announced the unaudited full year 2023 financial statement which revealed a strong growth in earnings to N310.0 billion with an earning per share of N8.6 against N3.8 recorded in 2022.

The positive earnings reflected higher operating income of 85.8 percent year on year to N1.1 trillion, which rode off the 45.9 percent and 149.6 percent increases in net interest income and non-interest revenue, respectively.

Consequently, the cost-to-income ratio improved to 48.7 percent from the full year 2023 2:61.7 percent.

Nonetheless, the operating expenses increased by 46.8 percent to N534.3 billion, and impairment charges rose by 2.1x to N200.4 billion.

On the former, the higher OPEX emanated from the increases in personnel expenses (+51.9 percent), maintenance (+76.7 percent) and advert & corporate promotions (+162.2 percent).

For the latter, the higher impairment charges were driven by a 2.9x increase in impairment loss for loans and advances.

In Q4’23, earnings came in higher by 49.2 percent QoQ to N73.5 billion. This performance highlighted the robust 247.5 percent increase in NIR that rode on the impact of N435.1 billion in net gain from financial instruments at FVTPL.

Overall, operating income improved by 87.3 percent quarter on quarter which masked the 4.7x jump in impairment charges and the 50.8 percent growth in OPEX.

FBNH’s annualised ROE and ROA stood at 21.9 percent against 14.5 percent in full year 2022 and 2.3 percent against 1.4 percent in full year, respectively.

Leave a Reply