Nigeria’s headline inflation hits 34.19 percent as food inflation stood at 40.87percent in June

By Kayode Ogunwale

The latest inflation report released by the National Bureau of Statistics (NBS) reveals that Nigeria’s headline inflation rate experienced another upsurge in June 2024.

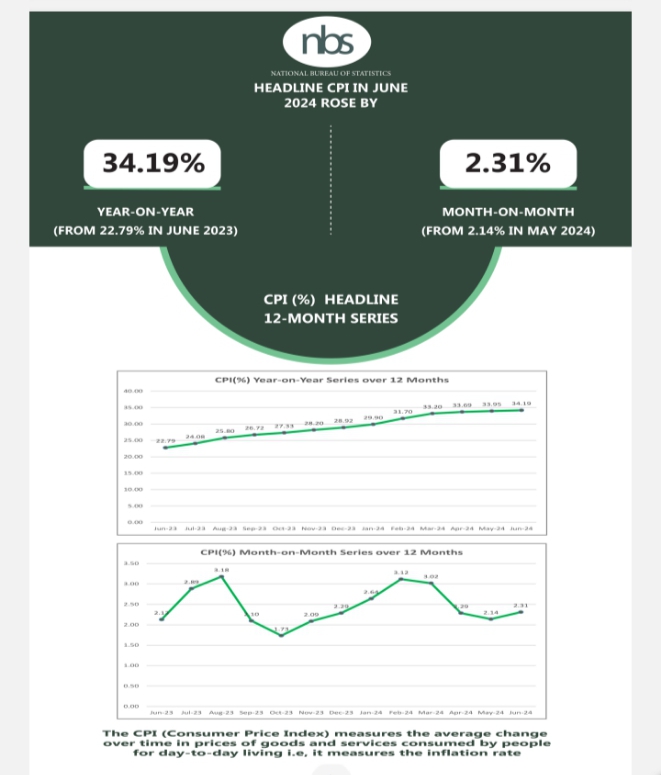

The inflation rate escalated by 0.24 percent climbing from 33.95 percent in May 2024 to 34.19 percent in June 2024. This continuous rise in inflation poses significant challenges to the economy, impacting consumers’ purchasing power, businesses’ production costs, and overall economic stability.

The inflationary pressures could potentially lead to higher prices of goods and services, reducing households’ real income and eroding savings.

The persistent increase in inflation calls for careful monitoring and proactive measures by policymakers to mitigate its adverse effects on the economy. Addressing the root causes of inflation, such as supply chain disruptions, currency depreciation, and rising global commodity prices, is crucial for containing inflationary pressures.

Additionally, implementing sound monetary and fiscal policies to stabilize prices and restore confidence in the economy is vital to steering Nigeria towards sustainable economic growth and development.

The NBS 2024 inflation report, showed that on a year-on-year basis, the headline inflation rate recorded an 11.40 percentage point increase when compared to the June 2023 inflation rate of 22.79 percent, an indication that the cost of living in Africa’s most populous country has risen significantly within the past year.

Meanwhile, on a month-on-month basis, the inflation rate for June 2024 stood at 2.31 percent, 0.17 percent higher than the previous month’s rate of 2.14 percent. The comparatively higher rate of price increase month-over-month suggests a higher rate of inflationary pressure in June 2024 compared to the previous month.

The percentage change in the average consumer price index (CPI) for the twelve months ending June 2024 over the average of the CPI for the previous twelve-month period was 30.00 percent, representing an 8.45 percent increase compared to 21.54 percent recorded in June 2023.

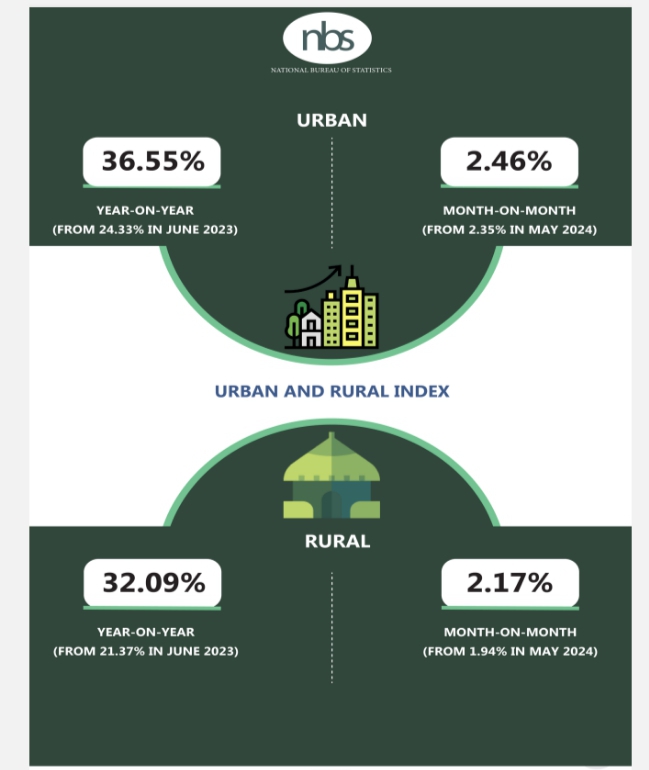

The recent inflation report from the NBS revealed worrisome figures in the urban CPI category, with year-on-year inflation rate in June 2024 reaching 36.55 percent. This represents a 12.23 percentage point increase from the 24.33 percent recorded in May 2023.

On a month -on-month basis, the urban inflation rate was 2.46 percent in June 2024, 0.11 percentage points higher compared to May 2024’s 2.35 percent. The corresponding twelve-month average for the urban inflation rate was 32.08 percent in June 2024. This was 9.70 percentage points higher compared to the 22.38 percent reported in May 2023.

The inflation report for June 2024 also highlighted the inflationary pressure in the rural CPI category, which recorded a year-on-year inflation rate of 32.09 percent, a 10.71 percentage point increase from the 21.37 percent recorded in June 2023.

On a month-on-month basis, the rural inflation rate in June 2024 was 2.17 percent, up by 0.23 percentage points compared to 1.94 percent in May 2024. The corresponding twelve-month average for the rural inflation rate in June 2024 was 28.15 percent. This was 7.39 percentage points higher compared to the 20.76 percent record in June 2023.

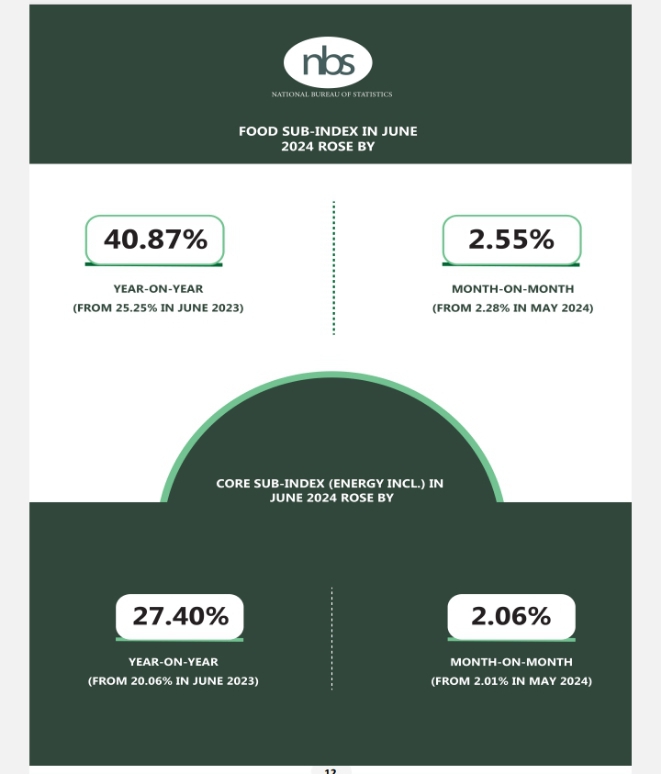

The inflationary pressures on the food sector in Nigeria continued to intensify in June 2024, with the year-on-year food inflation rate jumping to 40.87 percent. This represents a 15.62 percentage point increase from the already high 25.25 percent rate recorded in June 2023, signaling further deterioration in the affordability of basic foodstuffs for Nigerians.

The NBS attributed the rise in food inflation on a year-on-year basis to increases in prices of millet whole grain, garri, guinea corn, etc (bread and cereals class), yam, water yam, coco yam (potatoes, yam & other tubers class), groundnut oil, palm oil, etc (oil & fats class) and catfish dried, dried fish-sardine, mudfish (fish class), etc.

The month-on-month food inflation rate in June 2024 also witnessed a surge at 2.55 percent, 0.26 percent above 2.28 percent.

The NBS attributed the rise in food inflation on a month-on-month basis to the increase in the average prices of groundnut oil, palm oil, etc (oil & fats class), water yam, coco yam, cassava, etc (potatoes, yam & other tubers class), tobacco, catfish fresh, croaker, mudfish fresh, snail, etc.

The average annual rate of Food inflation for the twelve months ending June 2024 over the previous twelve-month average stood at 35.35 percent, which was 11.31 percentage points increase from the 24.03 percent change recorded in June 2023.

The “All items less farm produces and energy” or Core inflation, which excludes the prices of volatile agricultural produces and energy stood at 27.40 percent in June 2024 on a year-on-year basis; up by 7.34 percent when compared to the 20.06 percent recorded in June 2023. The highest increases were recorded in prices of rents (actual and imputed rentals for housing class), bus journey intercity, taxi journey per drop, etc (under passenger transport by road class), accommodation service, and X-ray photography, consultation fee of a medical doctor, laboratory service, etc (under medical services class), and pharmaceutical products.

The month-on-month core inflation rate like the headline and food also increased during the period in review to 2.06 percent from 2.01 percent recorded in May 2024, indicating an increase of 0.05 percent.

The average twelve-month annual inflation rate stood at 24.06 percent for the twelve months ending June 2024, 5.59 percentage points higher than the 18.47 percent recorded in June 2023.

Leave a Reply